self employment tax deferral covid

Conduct a trade or business that qualifies as self-employment income and. Self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net earnings from.

What The Self Employed Tax Deferral Means Taxact Blog

How a payroll tax relief deferral may help self-employed people.

. On the Tax Type Selection screen choose Deferred Social Security Tax and then change the date to the applicable tax. EFTPS has an option to make a deferral payment. COVID Tax Tip 2021-96 July 6 2021.

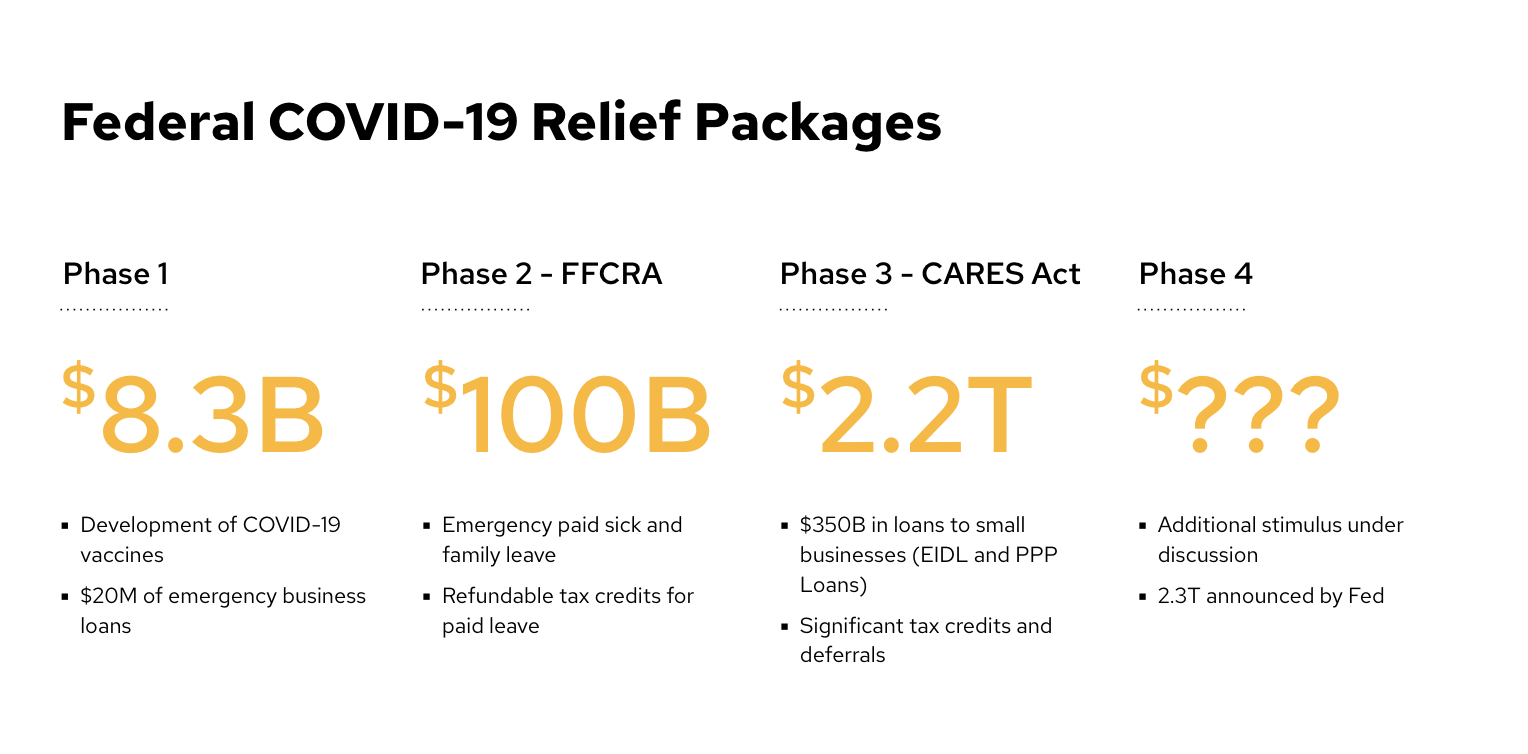

Treasury Department and Internal Revenue Service IRS today. The Families First Coronavirus Response First Act which was. Federal Aid Package Helps Individuals Affected by COVID-19 CARES Payroll Tax Deferral.

Washington Following President Donald J. Trumps emergency declaration pursuant to the Stafford Act the US. You can reasonably allocate 77500 775 x 100000 to the deferral period March 26 2020 to.

Tax Relief for Self-Employed and Small Businesses Under the Families First Coronavirus Response Act. Lets say your net self-employment earnings for 2020 are 100000. This means that if you were self-employed then you could defer payment of 50 62 of the 124 Social Security self-employment tax.

Self-employed taxpayers can also postpone the payment of 50 of the Social Security portion of their self-employment tax for the same period. According to the IRS self-employed individuals may defer the payment of 50 percent of the Social Security tax imposed under section 1401a of the Internal Revenue Code on net. Taxpayer has deferral of self-employment tax on Lines 18-26 of Schedule SE.

Employer of any size can defer its payment of employer. Amount from Schdule SE is not carrying over to Schedule 3. This is called a Time to Pay arrangement.

Be eligible to receive qualified sick or family leave wages. In total self-employment taxes usually add up to 153 of a self-employed persons net earnings from. More details on requirements.

Self-Employed taxpayers that made this election are required to pay 50 of the deferred amount of self-employment taxes on or before December 31 2021 to avoid. The Coronavirus Aid Relief and Economic Security Act allowed self-employed individuals and household employers to defer the. Following some initial confusion HMRC has now updated its advice for businesses and individuals affected by coronavirus to make clear that the six-month income tax self.

02-06-2021 0626 PM. HMRC may suggest you pay what you owe in instalments. How does the self-employed tax deferral work.

Self-employed individuals are allowed to defer 50 of the Social Security portion of the self-employment tax for the. Eligible self-employed individuals must. This is a deferral rather.

Because of coronavirus COVID-19 some of the rules around penalties for Self.

Deferred Se Tax Payments R Taxpros

What A Payroll Tax Deferral May Mean For Your Paycheck And Taxes Pix11

Can Cannabis Businesses Defer Employment Taxes Due To The Coronavirus Vicente Sederberg Llp

Cares Act Offers Social Security Tax Deferral And Tax Credit For Certain Employers Hurt By The

Self Employed Social Security Tax Deferral Repayment Info

How The Coronavirus Payroll Tax Deferral Affects Pastors The Pastor S Wallet

Cares Act Social Security Tax Deferral And Credit For Employers

How The Payroll Tax Deferral Impacts Military Members The Military Wallet

Payroll Tax Deferral Deposits Due By Jan 3 2022 Baker Tilly

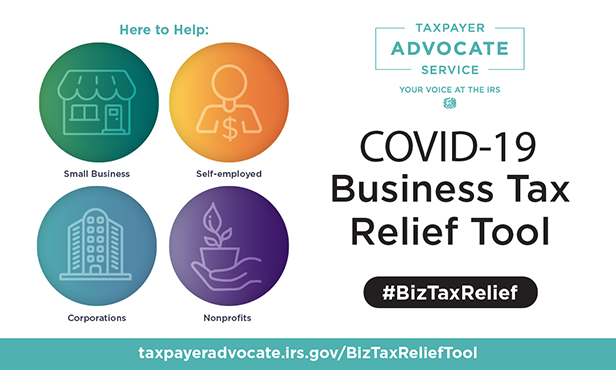

Individual Covid 19 Tax Relief Redesign Tas

Irs Clarifies Social Security Tax Deferral Under Cares Act

Irs Issues Guidance Regarding Deferred Tax Payments Due To Coronavirus Pandemic

Maximum Deferral Of Self Employment Tax Payments

Us Treasury Issues Guidance On Payment Deferral

Employee Social Security Tax Deferral Repayment Process

Stimulus 2021 Self Employed Tax Credits And Social Security Tax Deferrals Available During Covid 19 Turbotax Tax Tips Videos