federal income tax definition

Heres how the IRS defines income tax. Income tax is used to fund public services.

How Do Taxes Affect Income Inequality Tax Policy Center

An official form that has to be completed with information about ones income and expenses and.

. A tax paid on income over a certain amount. The federal income tax rate in the United States ranges from 15 to 39 depending on the size of the profit. Federal Income Tax means any Tax imposed by Subtitle A of the Code and any interest penalties additions to tax or additional amounts in respect of the foregoing.

Economics a personal tax usually progressive levied on annual income subject to certain deductions. Tax Regulations means the. The taxes that most people worry about though are federal income taxes.

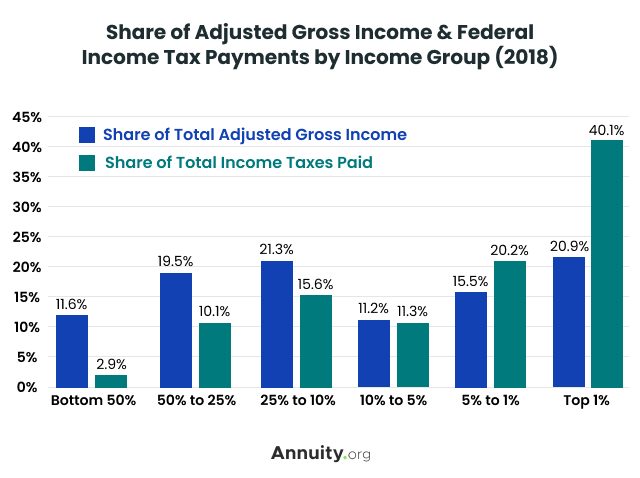

One set of rules. Taxes on income both earned salaries wages tips. One set of rules applies to individual income and another to corporate income.

Federal income tax synonyms Federal income tax pronunciation Federal income tax translation English dictionary definition of Federal income tax. The federal income tax is a source of revenue for the federal government. Federal income tax is a tax on income and is imposed by the US.

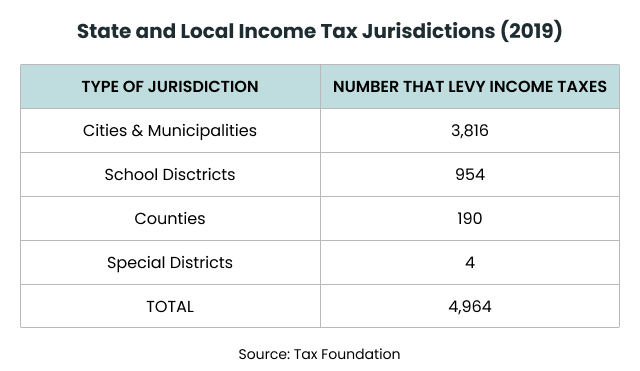

Collins English Dictionary Complete and Unabridged 12th Edition 2014. Income taxes are levied by the federal government and by a number of state and local governments. Federal income tax is a tax on a range of certain kinds of income.

The IRS collects the tax. A tax levied on the annual earnings of an individual or a corporation. So its easy to find out how much federal income tax to pay.

A tax levied on net personal or business. Federal income tax is a tax levied on the income of individuals corporations trusts and other legal entities. Federal Income Taxes synonyms Federal Income Taxes pronunciation Federal Income Taxes translation English dictionary definition of Federal Income Taxes.

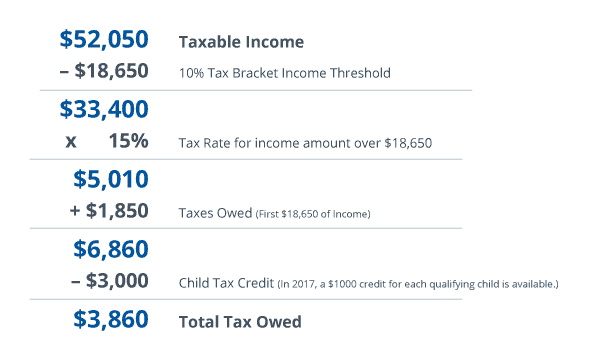

A tax levied on net. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings. Taxpayers generally calculate and pay federal income tax by filing an IRS Form 1040 by April 15 of each.

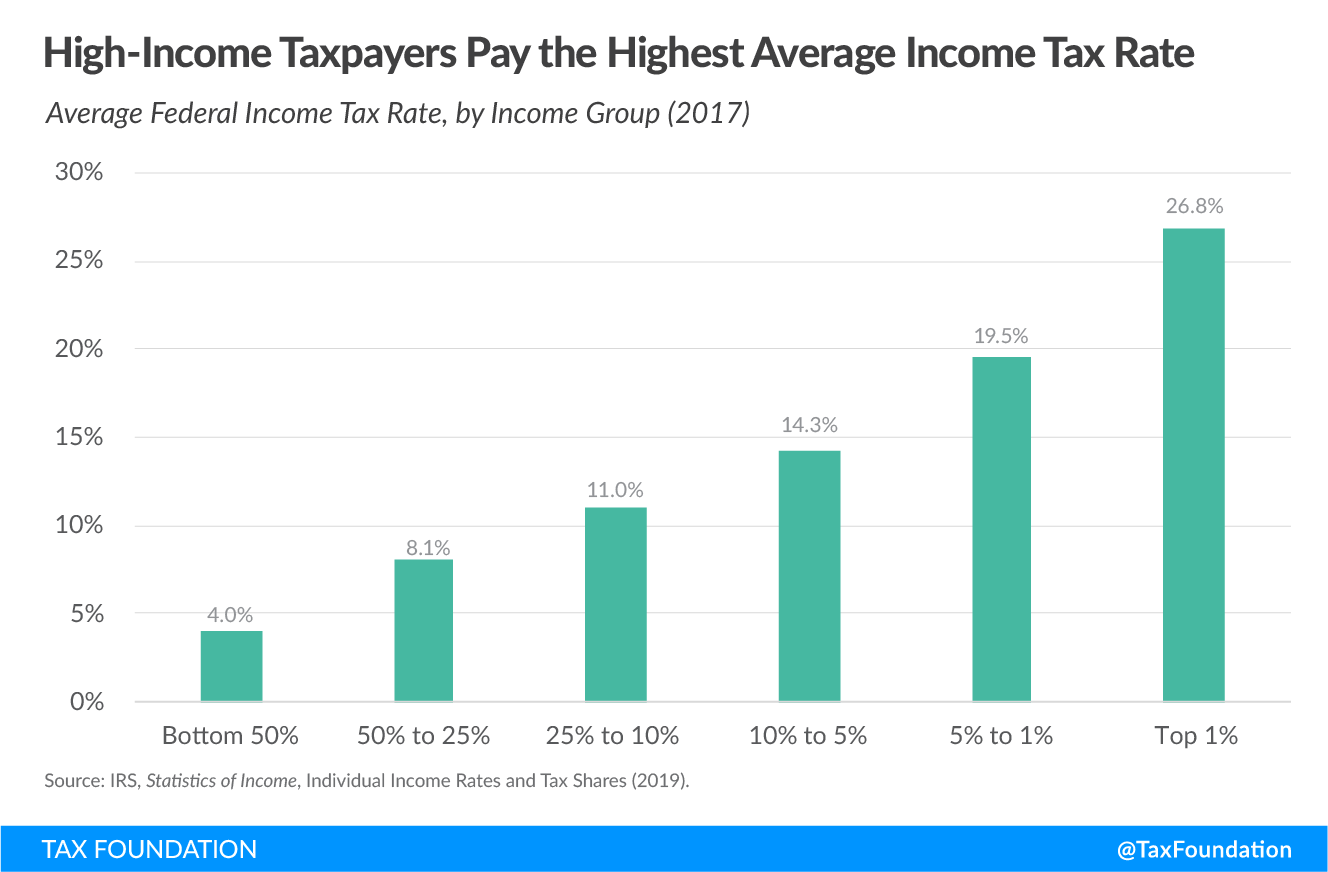

An individual income tax or personal income tax is levied on the wages salaries investments or other forms of income an individual or household earns. Federal income taxes have been collected since 1913 when they were authorized by the 16th Amendment to the Constitution. Most states also assess income taxes but at a substantially.

Income tax is a type of tax that governments impose on income generated by businesses and individuals within their jurisdiction. Income taxes are levied by the federal government and by a number of state and local governments. Federal Income Taxes means any tax imposed under Subtitle A of the Code including the taxes imposed by Sections 11 55 59A and 1201a of the Code including any interest additions to.

Businesses employers must follow the IRS-determined tax schedule to. Impuesto sobre la renta.

Types Of Taxes Income Property Goods Services Federal State

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Average Tax Rate Definition Taxedu Tax Foundation

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

Government Revenue Taxes Are The Price We Pay For Government

/tax_shutterstock_584351497-5bfc325b46e0fb00511aeca8.jpg)

Taxable Income Vs Gross Income What S The Difference

Income Tax Definition What Are Income Taxes How Do They Work

What Are Tax Credits And How Do They Differ From Tax Deductions Tax Policy Center

What Is Local Income Tax Types States With Local Income Tax More

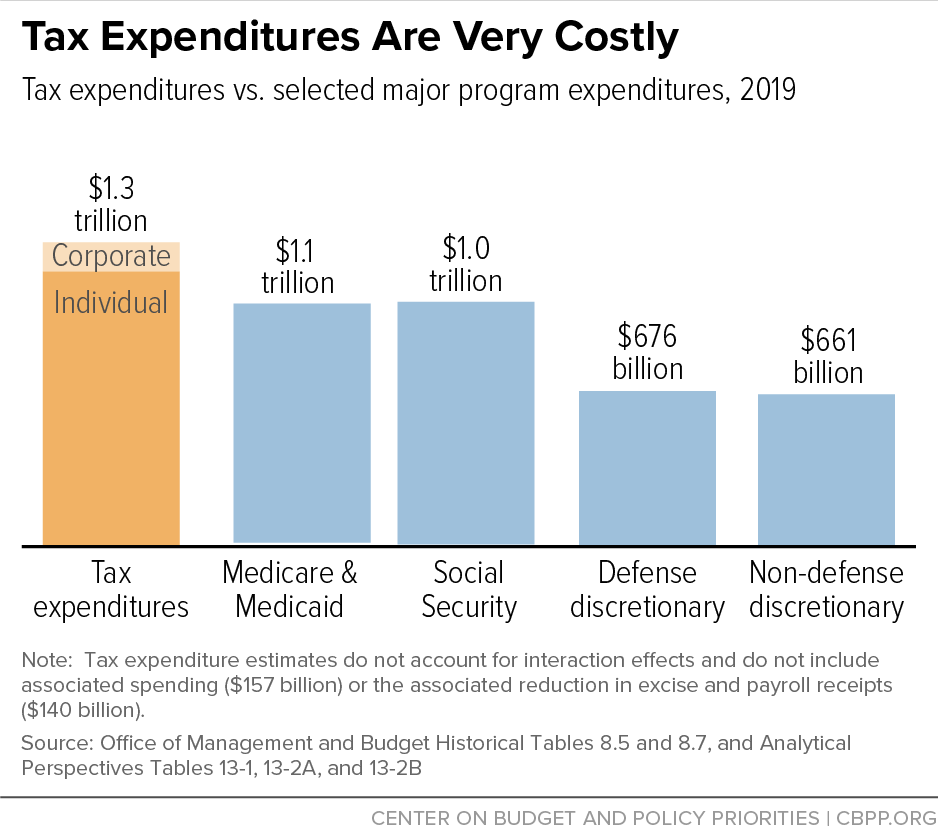

Policy Basics Federal Tax Expenditures Center On Budget And Policy Priorities

How Do State And Local Individual Income Taxes Work Tax Policy Center

Income Tax Definition What Are Income Taxes How Do They Work

Standard Deduction Tax Exemption And Deduction Taxact Blog

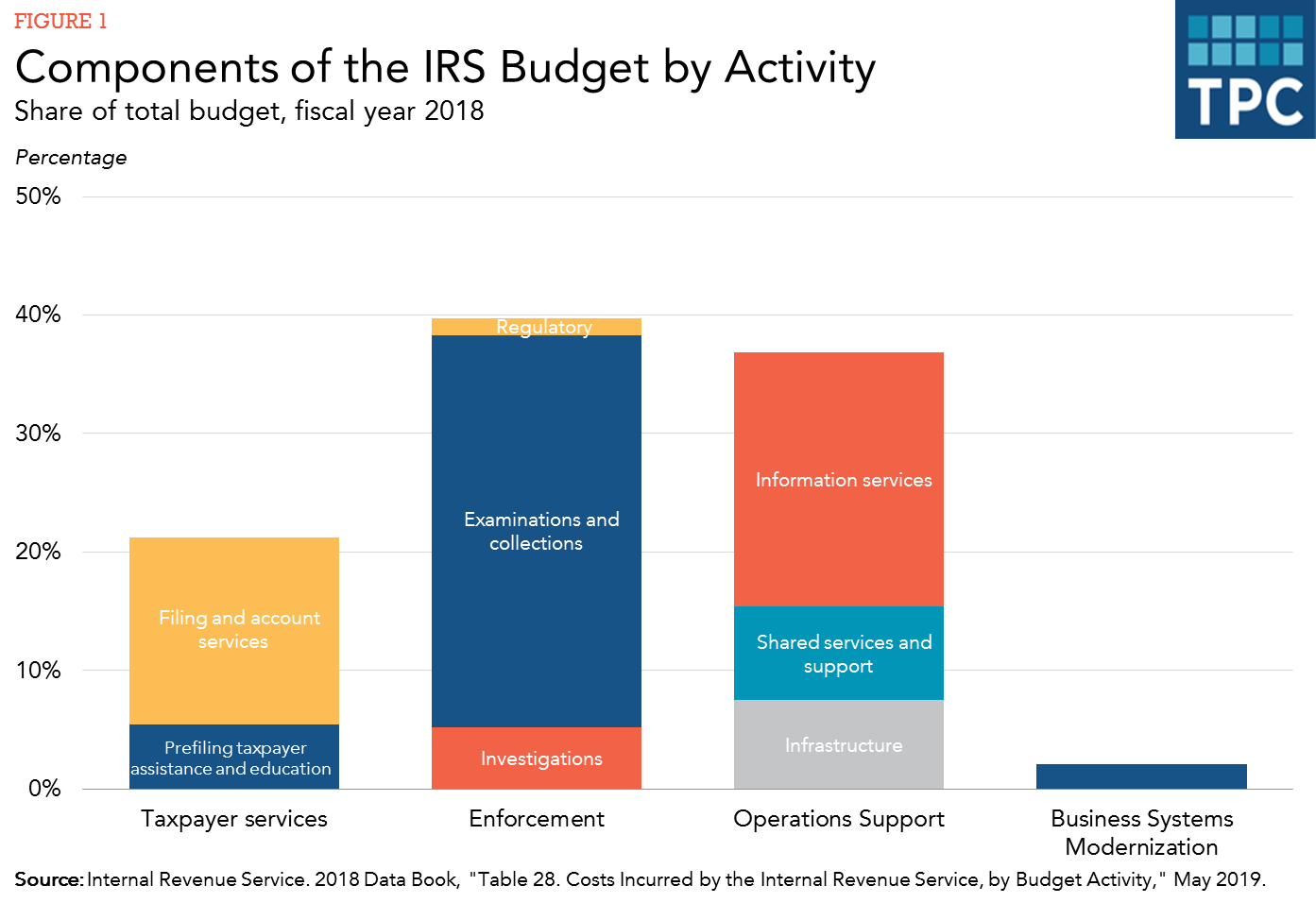

What Does The Irs Do And How Can It Be Improved Tax Policy Center

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

/tax_refund-7f8e7a5064a0411381a554001e842085.jpg)

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)

/Incometaxes-9dacb2fc1d314896821b07f3933f0c4e.png)